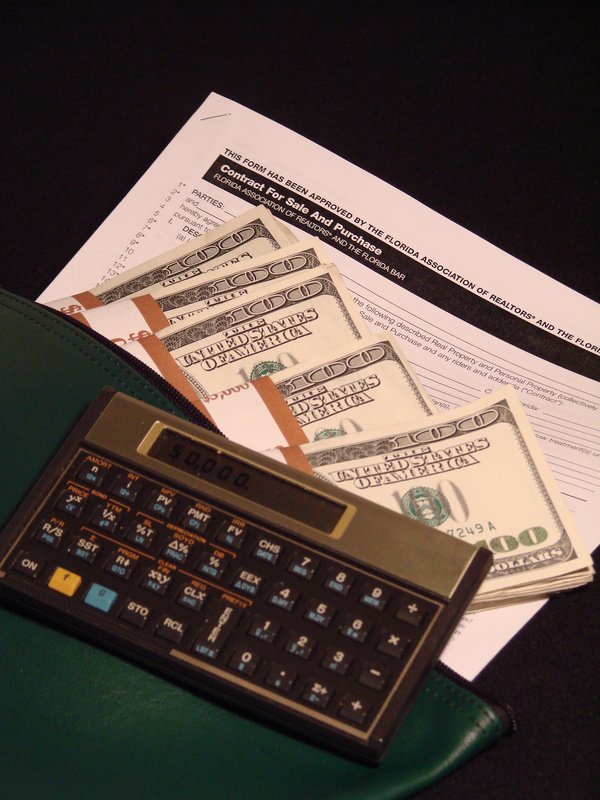

Need A Mortgage?

Need a Mortgage – Check This List Out!

From the time an applicant walks through the door to the actual closing, lenders have become very cautious about the entire home mortgage loan process. Even when an applicant has a good down payment and good credit, issues arising at the last minute can result in the loan being denied.

Here are four tips to help applicants who need a mortgage to ensure they don’t encounter last-minute problems right before their mortgages close:

1. Avoid major purchases and large cash withdrawals.

Even after the mortgage loan has been approved, high-dollar purchases should be avoided until after closing. Many applicants are under the assumption that an approval is the end of the deal, but this isn’t the case. Lenders view major purchases as more debt for the applicant and more risk to themselves. They’ve been known to pull mortgages right out from under applicants that make major purchases, such as a car, during the mortgage process. Since lenders assess an applicant’s cash reserves during the loan approval, paying for such purchases with cash is even out of the question.

2. Don’t forget about last-minute credit checks.

The new rules contained in Fannie Mae’s loan quality initiative mean that lenders are likely going to do another credit check shortly before the mortgage closing date. This is when the lender will discover any major purchases mentioned above. It’s also the point that the lender will see if an applicant has been delinquent in paying credit card, existing mortgage, and other debts since first applying for the mortgage loan. Such delinquencies can cause a dip in the applicant’s credit score. In fact, even just applying for a new credit card between the approval and closing dates can possibly result in a credit score dip. Don’t jeopardize the standing of a loan by not being prepared for a second credit check.

3. Postpone big career or job changes.

Lenders carefully consider an applicant’s job stability and salary during the loan approval process. If the equation changes, such as when an applicant changes jobs, the mortgage loan may be either pulled completely or delayed until the individual can demonstrate that the new job is stable and provides the financial resources necessary to pay the mortgage. Lenders especially frown upon an applicant changing industries during the mortgage loan process. If possible, postpone making any changes to you employment status until after you have the keys to your new home in hand.

4. Expect unexpected costs.

Closing-cost surprises are commonplace, which is why it can be a big mistake to put all of your reserved money toward the mortgage down payment. Closing costs can change and can amount to as much as three percent of what the applicant is paying for a new house. In other words, someone buying a $100,000 home could potentially pay as much as $3,000 in closing costs. The last thing you wants is to make it all the way to the closing cost portion and find that you lost the home because you haven’t set enough money aside to cover mortgage rate points or closing fees.