Are Reverse Mortgages a Good Tax Strategy?

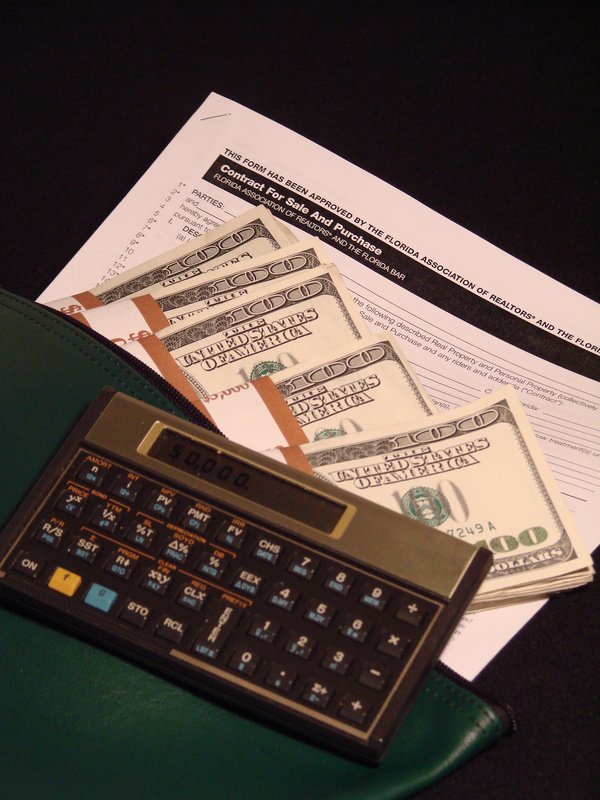

Are Reverse Mortgages a Good Tax Strategy? Reverse mortgages are becoming increasing popular – especially for older people who want to tap the equity in their homes. They can provide a convenient source of financing for seniors who are “home rich but cash poor.”

Qualified individuals can keep control of their principal residences while converting some of the equity in the property into cash. Seniors often cannot qualify for conventional “forward” home equity mortgages due to low income, which is one reason why a reverse mortgage might be a good alternative.

But before signing on the dotted line, it’s important to understand the tax consequences.

Common question: With a reverse mortgage, is the mortgage interest deductible on the homeowner’s federal tax return?

Answer: Yes and no. The first $100,000 of reverse mortgage principal will most likely meet the tax-law definition of home equity debt. Therefore, the borrower can generally claim itemized deductions for interest on up to $100,000 worth of reverse mortgage loan principal.

(If the homeowner is subject to the alternative minimum tax, however, the write-off may be disallowed.)

Here’s the problem: The interest cannot be deducted until it’s actually paid in cash, as opposed to being added to the reverse mortgage loan principal. Because of the way most reverse mortgages work, payment in cash may not occur until long after the loan is taken out, assuming all the accrued interest is in fact tacked onto the loan principal. (See right-hand box to understand how reverse mortgages work.)

To summarize, no current federal income tax deduction is allowed for interest that is added to the reverse mortgage loan principal, since the homeowner is accruing – but not paying – mortgage interest at this point. If a current tax advantage is an important factor in the homeowner’s decision to obtain a reverse mortgage, this may not be the right choice.(IRS Revenue Ruling 80‑248.)

Even so, a reverse mortgage can make good financial sense in the right circumstances. Contact your tax adviser if you have questions or want more information to find out the right answer for you. Are Reverse Mortgages a Good Tax Strategy?

About Deborah Laemmerhirt

Let me assist you in finding everything you need to know about buying or selling a home! As the preeminent real estate professional in my community, I am dedicated to providing the finest service available while breaking new ground.

Because the real estate industry is becoming more sophisticated and challenging every day, you need a professional that understands the industry and is positioned to stay ahead of the game.

I go the extra mile to help you achieve your goals. That’s why I constantly research the home, market and estate values so your home is priced effectively from day one. I also make sure the public knows your home is for sale by using innovative marketing techniques to attract potential buyers.

As an Internet-savvy real estate representative in Connecticut, I’ve had the opportunity to help many home buyers find their ideal homes and many sellers obtain top dollar for their homes. Buying or selling a home is one of the largest financial transactions that most people ever undertake, so I will help you through every step of the process. My goal is to make your home selling or buying experience as easy and enjoyable as possible.

My services include:

Explaining the home selling and buying process thoroughly

Diligently selecting homes that meets your criteria

Pricing your home correctly and implementing a unique yet proven marketing plan

Negotiating on your behalf

Tracking the closing process to ensure a smooth transaction

I welcome the opportunity to address any questions you might have about buying, selling or current market conditions. Please call or e-mail me any time, and I will be happy to discuss your next steps in the buying or selling process.

I specialize in both Residential and Commercial Properties.

I also head a Real Estate Group to provide you with expert service and support.

Areas of Expertise

Making transitions in your life is challenging. You may be moving from out of town, a different state, internationally or just next door! Regardless of the distance I am prepared to respond to your unique needs.If you are a BUYER looking to downsize, up-size, want a new construction, desire a condominium, to invest, even if this is your first home, I will design a unique plan to fulfill your needs in a reasonable time frame, with the best negotiated price and the least amount of inconvenience.For my Home Sellers, I have an innovative marketing plan that will leave nothing to chance. Just call, and I would be happy to share the DIFFERENT and SUCCESSFUL TOOLS I utilize on each of my listings.

I have lived in Connecticut for over 35 years. I practice Real Estate in Fairfield County, New Haven County and Litchfield County. This includes, but is not limited to Bethel, Bridgewater, Brookfield, Danbury, Harwinton, Kent, Litchfield, New Fairfield, New Milford, Newtown, Oxford, Ridgefield, Redding, Roxbury, Sherman, Southbury, Warren, Washington, Westport and Wilton.