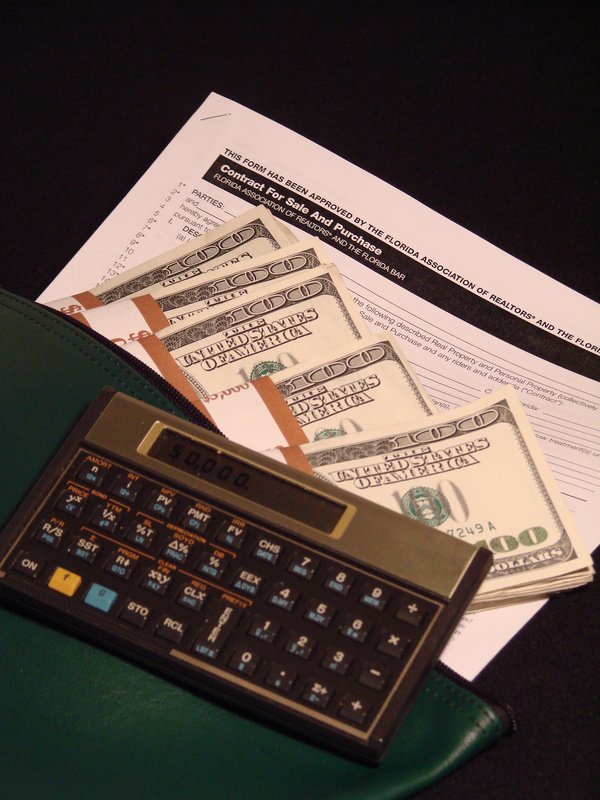

First Time Home Buyers

First Time Home Buyers. Would you go to a housing counseling education program if it would save you nearly $10,000 over the life of your mortgage? The Federal Housing Administration is betting you would.

It’s proposing a new program that would discount mortgage insurance premiums for homeowners who agree to undergo housing counseling before getting an FHA mortgage.

Lenders typically make you buy mortgage insurance when you put down less than 20 percent on a home. The policy generally pays the lender if you fail to make your payments.

If FHA approves the discount program, you’ll get a 50 basis point discount in the upfront FHA mortgage insurance premium you pay at closing, after you take the course. A basis point is 1/100th of 1 percent, so 50 basis points is one-half of one percent. You’ll also get a 10 basis point reduction on your annual mortgage insurance premium.

If you do post-closing counseling and go on to pay your mortgage on time for two years, you’ll get another 15 basis points knocked off your annual mortgage insurance premium.

On the average $180,000 FHA mortgage, you’ll save $9,800 over the life of the loan by completing the housing counseling course and paying on time, FHA estimates.

Why is FHA so hot on homeownership counseling? It has research showing mortgage problems are 29 percent lower for first-time homebuyers who get counseling and 15 percent lower for all homebuyers who get counseling, compared to buyers who get no counseling.

During housing counseling, you’ll receive individual, objective advice on reaching your housing and financial goals, homeowner rights and responsibilities and managing your credit and savings. First Time Home Buyers – check this out!

The proposed program is part of a bigger effort to help Americans better manage their credit. This will help further homeownership and build lasting wealth.

According to the Urban Institute, the average credit score for loans sold to government-sponsored mortgage companies is 752. Currently, there are 13 million people with credit scores ranging from 580 to 680.

“Shutting these consumers out of the market hurts American families and undermines our efforts to build more stable communities, create pathways to the middle class and increase homeownership opportunities for minority and low-wealth borrowers,” FHA officials said when they announced the proposed program earlier this month. First Time Home Buyers.

Mortgage costs could rise in the upcoming year!

About Deborah Laemmerhirt

Let me assist you in finding everything you need to know about buying or selling a home! As the preeminent real estate professional in my community, I am dedicated to providing the finest service available while breaking new ground.

Because the real estate industry is becoming more sophisticated and challenging every day, you need a professional that understands the industry and is positioned to stay ahead of the game.

I go the extra mile to help you achieve your goals. That’s why I constantly research the home, market and estate values so your home is priced effectively from day one. I also make sure the public knows your home is for sale by using innovative marketing techniques to attract potential buyers.

As an Internet-savvy real estate representative in Connecticut, I’ve had the opportunity to help many home buyers find their ideal homes and many sellers obtain top dollar for their homes. Buying or selling a home is one of the largest financial transactions that most people ever undertake, so I will help you through every step of the process. My goal is to make your home selling or buying experience as easy and enjoyable as possible.

My services include:

Explaining the home selling and buying process thoroughly

Diligently selecting homes that meets your criteria

Pricing your home correctly and implementing a unique yet proven marketing plan

Negotiating on your behalf

Tracking the closing process to ensure a smooth transaction

I welcome the opportunity to address any questions you might have about buying, selling or current market conditions. Please call or e-mail me any time, and I will be happy to discuss your next steps in the buying or selling process.

I specialize in both Residential and Commercial Properties.

I also head a Real Estate Group to provide you with expert service and support.

Areas of Expertise

Making transitions in your life is challenging. You may be moving from out of town, a different state, internationally or just next door! Regardless of the distance I am prepared to respond to your unique needs.If you are a BUYER looking to downsize, up-size, want a new construction, desire a condominium, to invest, even if this is your first home, I will design a unique plan to fulfill your needs in a reasonable time frame, with the best negotiated price and the least amount of inconvenience.For my Home Sellers, I have an innovative marketing plan that will leave nothing to chance. Just call, and I would be happy to share the DIFFERENT and SUCCESSFUL TOOLS I utilize on each of my listings.

I have lived in Connecticut for over 35 years. I practice Real Estate in Fairfield County, New Haven County and Litchfield County. This includes, but is not limited to Bethel, Bridgewater, Brookfield, Danbury, Harwinton, Kent, Litchfield, New Fairfield, New Milford, Newtown, Oxford, Ridgefield, Redding, Roxbury, Sherman, Southbury, Warren, Washington, Westport and Wilton.